30 April 2025

Understanding worker misclassification in Italy: employee vs freelancer

Expanding your workforce in Italy? It’s a smart move—Italy offers skilled professionals, especially in tech, design, and engineering. But as you build a team, especially remotely, there’s a hidden risk you can’t ignore: worker misclassification.

Hiring someone as a freelancer when their work setup actually reflects that of a full-time employee isn’t just a grey area in Italy – it can trigger serious legal and financial penalties. Whether you’re a global startup onboarding remote developers or an established business using flexible talent models, understanding the difference between employees and freelancers in Italy is essential.

In this article, I’ll break down the legal distinctions, common mistakes, and consequences of misclassification. I’ll also explain how an Employer of Record in Italy can help you hire locally without risking your business.

Why correct worker classification is critical in Italy

Italian labour law is highly protective of workers. There’s a strong emphasis on job security, fair pay, and social protections. When you hire talent in Italy, you’re expected to respect the legal framework, and that includes classifying workers correctly from day one.

With the rise of remote work and international hiring, many businesses mistakenly treat long-term contributors in Italy as freelancers or independent contractors, assuming it’s the easiest way to avoid payroll taxes and local registrations. Unfortunately, this approach can backfire.

Employee vs. freelancer in Italian labour law

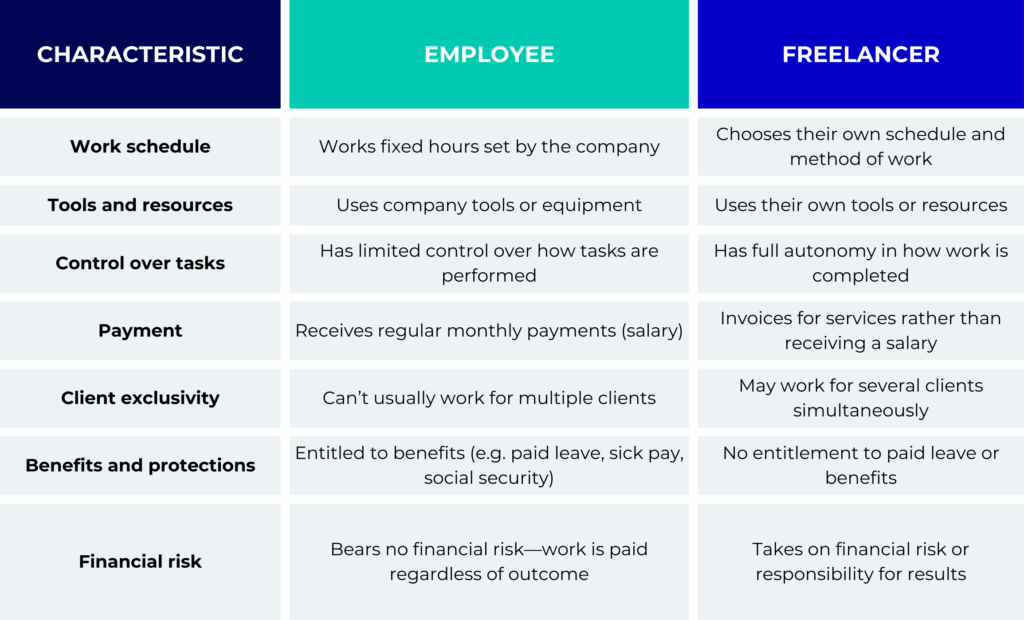

Under Italian law, a full-time employee (dipendente) is someone who works under the direction and control of their employer. In contrast, a freelancer or independent contractor (libero professionista) performs services independently and is not subject to employer control.

Italian law draws a sharp distinction between employees and independent workers. Employees are hired under subordination, which means the company controls how, when, and where they work. Freelancers, on the other hand, operate with autonomy. They manage their own time, work on multiple projects, and bear some financial risk.

In practice, the line can get blurry. A freelancer who sends invoices may still work like an employee if they’re closely tied to the company, lack control over their schedule, or use the employer’s tools and systems. These subtle signs can trigger reclassification, regardless of the contract in place.

Here’s how they differ in practice:

Let’s take a real-world example. Suppose a UK startup hires Giulia, a UX designer based in Bologna. She works Monday to Friday, uses the startup’s design software, attends team calls daily, and doesn’t take on other clients. Even though she invoices monthly and is listed as a freelancer, her setup looks like an employee’s. If challenged, the company could face fines and be forced to pay back taxes and social security contributions.

Common misclassification scenarios

Italian authorities take misclassification seriously. If a freelance relationship is deemed illegal or misleading, the employer could be ordered to reclassify the person as a full-time employee. This comes with backdated social security payments, tax contributions, and potentially a hefty fine. In some cases, companies may also face criminal charges, especially if the misclassification is seen as intentional or systematic.

Beyond the financial penalties, there’s reputational risk. Employment disputes can make future hiring more difficult and erode trust in your company’s compliance practices, especially if you’re building a presence in the EU.

And for the worker involved, misclassification means missing out on key benefits like health coverage, paid vacation, and job security, which can damage the long-term relationship.

Here is what you can do to avoid misclassification:

- Hiring a remote worker full-time as a freelancer to avoid setting up a local entity or handling payroll

- Using freelance contracts while requiring fixed working hours and regular reports

- Treating long-term collaborators as contractors despite them working like in-house staff

- Cross-border hiring without legal advice, assuming rules are the same across Europe

These situations are surprisingly common among startups, remote-first companies, and international teams. But they can be costly if not handled properly.

Legal and financial risks of misclassification in Italy

Misclassifying employees as independent contractors can trigger a range of penalties under Italian law, including:

Penalties for worker misclassification:

- Fines and sanctions from labour authorities

- Back payments of unpaid social contributions to INPS (National Social Security Institute)

- Reclassification of employment: Courts may order the worker to be classified as a full-time employee retroactively

- Liability for unpaid taxes on wages, benefits, and holiday pay

- Civil and criminal consequences in severe cases of intentional misclassification

- Reputational damage: Italian courts may publish decisions, which can hurt employer branding and future recruitment efforts

In short, misclassification isn’t worth the risk. Getting it right protects your business and shows respect for the local legal framework.

How to classify workers correctly

Look beyond the contract and focus on the reality of the working relationship. Does the worker report to a manager? Do you control their schedule or tasks? Are they dependent on your company for income?

A freelance contract must clearly indicate project-based work, payment per assignment, and the worker’s autonomy. An employment contract, on the other hand, includes job duties, working hours, salary, benefits, and compliance with company policies.

Local labour law specialists can review your hiring model and prevent accidental misclassification. But legal consultations aren’t always cheap, or scalable. That’s where a more accessible solution like an Employer of Record comes in.

How an Italian Employer of Record helps prevent misclassification

An Employer of Record is a local third-party provider that legally hires workers on your behalf. You manage the day-to-day work, while the EOR takes care of employment compliance, payroll, and tax obligations.

In Italy, this is particularly useful for companies that:

- Don’t have a local legal entity

- Want to onboard talent quickly and compliantly

- Need to ensure correct classification of workers from day one

This model is especially helpful for companies with small teams or a few scattered hires in Italy. It offers flexibility without compromising compliance, and it shows your commitment to ethical employment practices in every country where you operate.

Benefits of using an EOR for worker classification:

- Drafts fully compliant employment contracts based on Italian labour law

- Handles payroll and social security contributions to INPS

- Manages tax obligations, including IRPEF (personal income tax)

- Offers statutory benefits to employees (like paid leave and severance)

- Reduces the risk of reclassification by ensuring the legal structure matches the actual work arrangement

For example, a Canadian e-commerce brand wanted to retain Marco, an Italian digital marketer who had been working as a freelancer for two years. Rather than continue with an unstable freelance setup, they partnered with an Employer of Record in Italy.

The EOR hired Marco as a full-time employee under Italian law, handled all tax filings, and gave him access to local benefits. The company avoided misclassification penalties and retained a valuable team member, while Marco gained security and stability.

Worker misclassification in Italy

Worker misclassification in Italy isn’t just a technical error—it’s a compliance risk that can affect your bottom line, reputation, and team relationship. Understanding how employment law works locally has never been more critical as international hiring grows, especially in remote-first setups.

By learning the difference between employees and freelancers, being honest about how your teams function, and seeking local support when needed, you can avoid costly mistakes and build a strong, compliant foundation for growth.

If you’re unsure about your current setup or planning to hire in Italy without the legal hassle, partnering with an Employer of Record could be the right move. It’s a reliable way to stay compliant while building strong, long-term relationships with your team. Contact us to learn how our EOR services in Italy can help you hire with confidence and avoid costly misclassification risks.