10 June 2025

Subsidiary vs. branch office in Italy: which is the right choice?

Italy is one of Europe’s largest economies, offering access to a skilled workforce, robust infrastructure, and a strategic location at the heart of the European Union. For many international companies, Italy is an attractive market to expand into, but setting up operations in the country requires careful planning around your legal structure.

Are you opening a subsidiary? Launch a branch office? Or could you hire in Italy without a legal entity using an Employer of Record? Each option has different legal, tax, and compliance implications.

In this guide, we’ll explore the differences between a subsidiary and a branch office in Italy, introduce EOR as a flexible alternative, and help you decide which approach best suits your expansion goals.

What is a branch office in Italy?

A branch office in Italy, or sede secondaria, is considered an extension of the foreign parent company rather than a separate legal entity. Although it must be officially registered with the Italian Business Register (Registro Imprese), it does not hold its own legal personality. Instead, the branch operates under the identity of its parent company and conducts activities on its behalf.

This structure means that any contracts or financial obligations undertaken by the branch are legally bound to the parent company. The branch must still comply with certain local requirements, including obtaining a fiscal code and registering for VAT. It also needs to appoint a legal representative based in Italy to act on behalf of the foreign business locally. Any income generated by the branch is subject to Italian corporate taxation.

Many companies choose this route because it offers a faster and more affordable entry into the Italian market compared to setting up a fully incorporated subsidiary. The administrative requirements are also lighter, making it an appealing choice for businesses looking to carry out specific functions such as marketing or sales representation.

However, this model comes with limitations. Since the branch is not a separate legal entity, the parent company remains fully liable for any debts or obligations incurred in Italy. This lack of legal separation can make it more challenging to build trusted local partnerships or qualify for government contracts. There’s also a heightened risk of tax exposure, as the foreign entity is directly linked to the branch’s activities in Italy.

What is a subsidiary in Italy?

A subsidiary in Italy is a fully independent legal entity, typically formed as an SRL (Società a responsabilità limitata), which is similar to a limited liability company. While it is usually owned by a foreign parent company, it is registered under Italian law and operates according to Italian corporate governance.

The subsidiary has its own tax identification number, legal structure, and the authority to enter into contracts, hire employees, and manage its own finances. Because it operates separately from the parent company, liability is limited to the capital invested in the subsidiary, offering a layer of protection for the foreign entity.

This structure provides a strong foundation for establishing a long-term presence in Italy. It enhances credibility in the eyes of local customers, partners, and authorities, making it easier to establish partnerships, bid on tenders, and engage in broader commercial activities. The legal and financial independence of the subsidiary also means the parent company isn’t directly exposed to local risks.

However, setting up a subsidiary requires more time and investment than a branch office. It involves incorporating a new company under Italian law, complying with annual reporting obligations, and managing ongoing accounting and tax responsibilities. As such, it may not be the most efficient route for businesses seeking short-term presence or market testing.

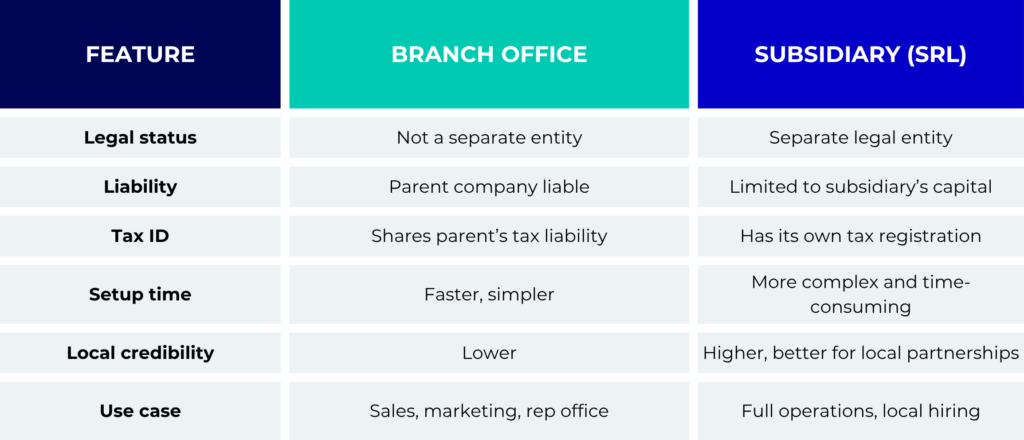

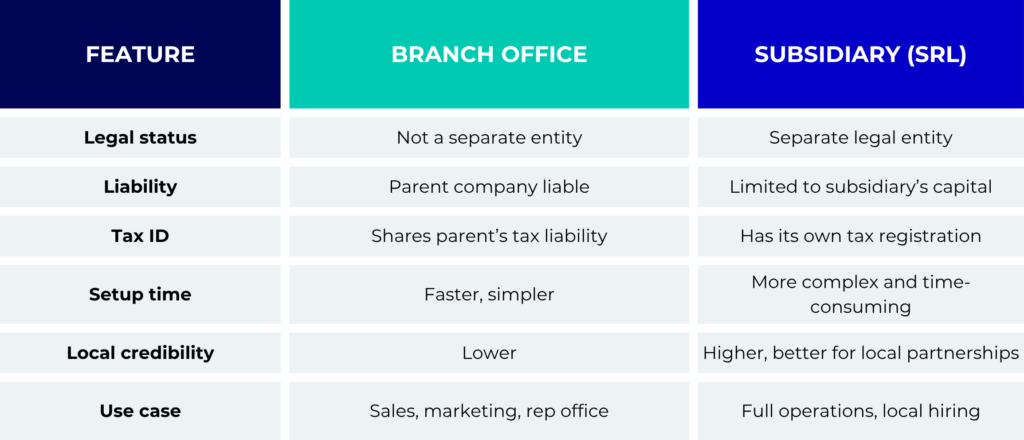

Subsidiary vs branch office: key differences

Understanding the key differences between a subsidiary and a branch office is essential when deciding how to establish a presence in Italy. While both options allow foreign companies to operate locally, they vary significantly in terms of legal independence, tax responsibilities, and operational flexibility.

How does an Employer of Record compare?

Suppose your goal is to hire employees in Italy without opening a branch or subsidiary. In that case, an Employer of Record in Italy may be the ideal solution.

An Employer of Record is a third-party provider that hires employees on your behalf in a foreign country. While you direct the day-to-day activities of the employees, the EOR handles everything related to employment contracts, payroll, taxes, and compliance under local law.

Benefits of working with an EOR in Italy:

- No need to register a legal entity or open a bank account

- Faster market entry — employees can be onboarded in weeks

- Full compliance with Italian employment law and social security requirements

- Reduced liability, as the EOR assumes the legal employer role

- Ideal for: hiring remote or hybrid employees, testing the Italian market before full entry, running project-based teams without infrastructure

For example, an American software company wanted to hire three developers in Milan to localise its product for the Italian market. Rather than setting up an SRL and dealing with incorporation delays, they partnered with an Employer of Record in Italy.

Within a few weeks, the developers were legally employed, fully compliant with local labour laws, and paid through the EOR’s payroll system. After 12 months of successful operations, the company moved forward with opening a subsidiary, but only once they were confident of long-term success.

When to choose a branch, subsidiary, or EOR?

Here’s a quick guide to help you decide:

Choose a branch office if:

- You want a basic presence in Italy without fully localising your operations

- You’re running non-commercial activities (e.g. liaison, research)

- You’re comfortable with the parent company holding full liability

Choose a subsidiary if:

- You want to run full operations in Italy and hire employees long-term

- You’re building a local brand or seeking local investment/partnerships

- You need full legal and tax independence

Choose an EOR if:

- You want to hire employees quickly and compliantly without setting up a company

- You’re testing the market or running a short-term project

- You want to reduce setup risk and administrative burden

Expanding into Italy

Expanding into Italy is a strategic move, but deciding how to do it is just as important as deciding where to go. Whether you choose a branch office, a subsidiary, or work with an Employer of Record in Italy, your decision will affect your speed to market, compliance risk, cost, and operational flexibility.

For many companies, especially those in the early stages of international growth, an EOR offers a low-risk, cost-effective way to hire in Italy without immediately incurring the costs of full incorporation. It’s also a powerful way to validate the market before investing in long-term infrastructure.

Contact our team to discover how EOR services in Italy can help you achieve your hiring goals and business expansion objectives, with reduced risk, minimal hassle, and full compliance.