7 October 2025

A Complete Guide to VAT in Italy for Expats

Moving to Italy is a dream woven from sun-drenched piazzas, incredible food, and a rich cultural tapestry. But for expats and entrepreneurs, the dream quickly meets reality with paperwork, bureaucracy, and taxes.

Understanding value-added tax in Italy, known as Imposta sul Valore Aggiunto (IVA), is not just for accountants. It’s a fundamental part of living and working there. Whether you’re starting a business, freelancing, or simply trying to understand your receipts, this guide will demystify the Italian VAT system for you.

The basics of VAT in Italy

VAT, or Value-Added Tax, is a consumption tax levied on most goods and services. It is not a tax on a company’s profit but on the value it adds at each stage of the supply chain. The end consumer ultimately bears the cost, which is why you see it clearly displayed on every invoice and receipt you receive.

For businesses, VAT in Italy is a transactional tax. They collect it from their customers on behalf of the state and, in return, can reclaim the VAT they have paid on their own business purchases. This mechanism makes them tax collectors in the supply chain.

For tourists and everyday residents, it’s simply a tax included in the price of your espresso, new sofa, or phone bill. Understanding this distinction is the first step to making the Italian VAT system work for you, not against you.

VAT for expats/freelancers vs business

For expats and freelancers in Italy, VAT obligations tend to be simpler but personally burdensome. They register for VAT as individuals, manage invoicing, file VAT returns themselves, and pay both income tax and social security contributions directly.

Businesses—whether incorporated in Italy or foreign entities with Italian operations, usually face more complex compliance. It includes:

- Multiple rates

- Electronic invoicing (SDI)

- Periodic VAT communications (LIPE)

- Foreign supplier rules

- Obligations like reverse charge

An umbrella company can be very helpful for freelancers or contractors who don’t want to manage this complexity. The service takes on the employer role, handles VAT liability, withholding, social contributions, and invoicing. Thereby letting the individual focus on the work.

For businesses seeking scale or international operations, using an Employer of Record in Italy lets them contract or employ staff in Italy without setting up a local entity. The EOR assumes VAT and payroll compliance responsibilities, ensuring both legal and tax obligations are met.

How VAT works in Italy: The mechanism

The practical application of VAT is a system of credits and debits. Imagine a furniture maker:

- They buy wood from a supplier for €1,000 + 22% VAT (€220). They pay €1,220.

- Then, they build a table and sell it to a shop for €2,000 + 22% VAT (€440). They charge the shop €2,440.

- The furniture maker must pay the Italian tax authority, Agenzia delle Entrate, the VAT they collected (€440), minus the VAT they paid (€220). So, they pay €220.

- The shop then sells the table to the final consumer, for €3,000 + 22% VAT (€660). They charge the consumer €3,660.

- The shop pays the tax authority the VAT they collected (€660), minus the VAT they paid to the furniture maker (€440). So, they pay €220.

In summary, the government receives €220 + €220 = €440, which is the full 22% VAT on the final sale price to the consumer. This system ensures tax is paid at every stage, but the financial burden lies with the final user.

Who must follow these rules? Any business or individual performing an economic activity independently and on a regular basis. This includes sole traders, freelancers, partnerships, and limited companies. If you are an expat generating income from within Italy, you are almost certainly obligated to understand VAT compliance in Italy.

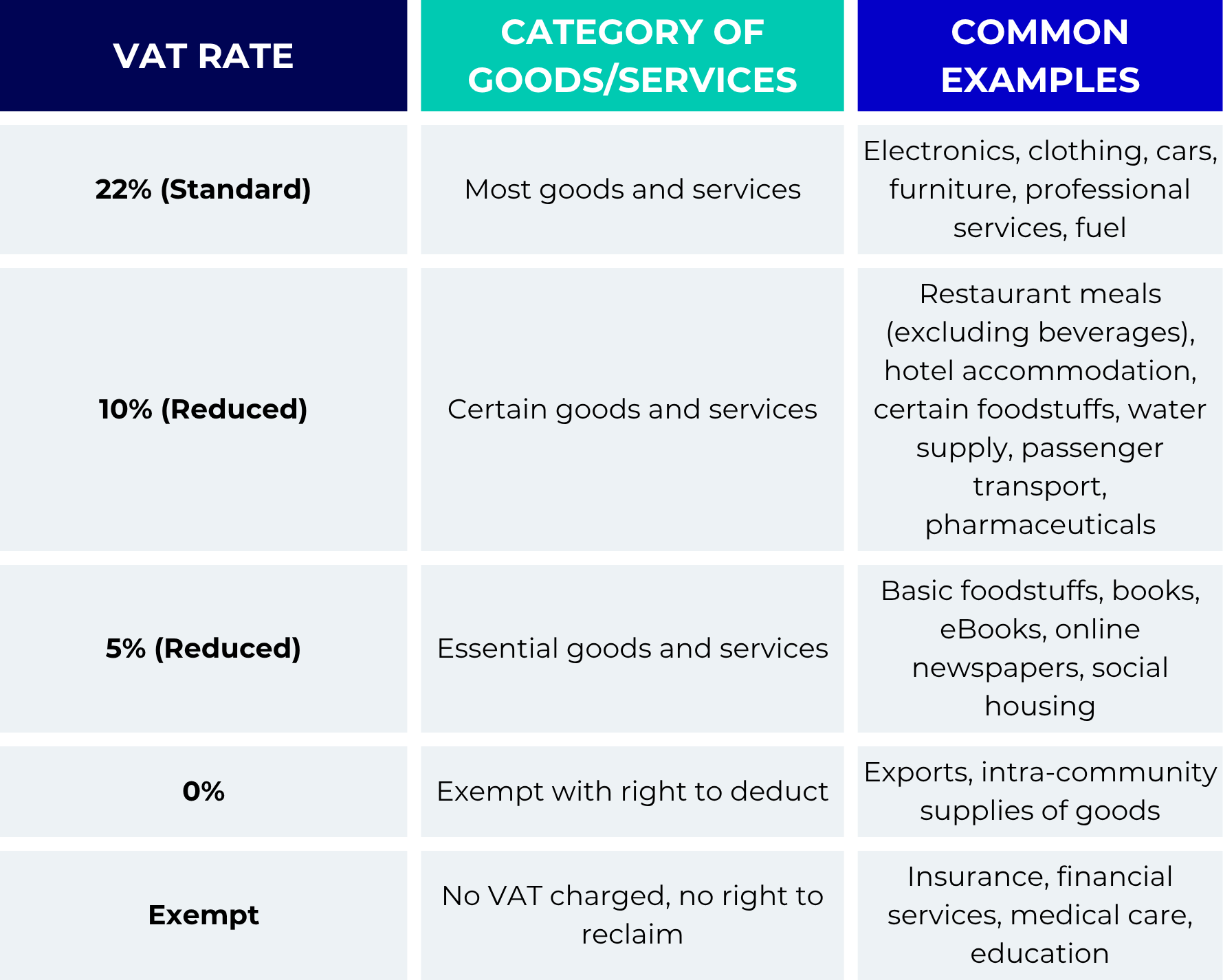

VAT rates in Italy

Italy employs a multi-tiered rate structure. The standard rate applies to most goods and services, while reduced rates exist for essentials.

Note: It’s worth noting that the Italy VAT rate for certain items can be subject to temporary changes. That’s because it is often used as a political tool to support specific sectors during economic hardship.

VAT registration in Italy

You must register for a VAT registration number if your annual turnover exceeds €85,000 for services or €70,000 for goods. However, this threshold does not apply to foreign businesses without an Italian establishment.

If you are a non-resident company making taxable supplies in Italy, you must register for VAT immediately, regardless of turnover. This often applies under the ‘distance selling’ rules for e-commerce or if you are holding goods in an Italian warehouse.

Furthermore, freelancers and self-employed individuals must register from the very first day of business activity, as you can see in our expat guide.

The process:

- Apply for a tax code (Codice Fiscale). This is your first step for any fiscal activity in Italy.

- Submit your application for a Partita IVA to the Italian Revenue Agency (Agenzia delle Entrate). The application will define your activity code (codice ATECO) and your VAT regime.

- Once approved, you will receive your VAT number, which must be displayed on all your invoices.

Timely registration is not a suggestion, but a legal requirement. Note that late registration can lead to fines ranging from 120% to 240% of the VAT due.

VAT compliance and filing

Registering is only the beginning, since ongoing compliance is where the real work lies. Here is the filing frequency that you need to keep in mind:

- Monthly: For large enterprises with very high turnover.

- Quarterly: The standard for most small to medium-sized businesses. You must still make a monthly prepayment if your quarterly VAT liability exceeds a certain amount.

- Annual: For very small businesses under a specific regime called regime forfettario, which has its own simplified rules.

What to report when filing a VAT report:

- Total sales and VAT collected.

- Total purchases, which is the VAT paid.

- The resulting VAT balance to be paid to the state or refunded.

Deadline and penalties

Note that VAT returns are typically due by the end of the month following the reference quarter. Whereas final annual VAT reconciliation is due by the end of February the following year.

Missing deadlines results in automatic penalties and interest charges. The Italian system is automated and unforgiving. Therefore, VAT compliance in Italy is non-negotiable, which is why partnering with an Employer of Record in Italy will help you avoid penalties.

VAT refunds and special cases

The Italian VAT system also provides mechanisms to reclaim paid VAT for tourists and foreign businesses.

For tourists

For tourists residing outside the EU, the process is a welcome perk. When purchasing goods in Italy, you can obtain a refund of the VAT included in the price upon departure from the European Union.

To qualify, the purchase from a single retailer must typically exceed a minimum amount (around €155), and you must request a properly completed and customs-stamped refund form from the store at the point of sale.

Present your unused goods, receipts, and passport at EU customs for validation before checking your luggage. The refund itself can then be processed immediately at an airport refund point or claimed afterwards.

For foreign businesses

For foreign businesses without a fiscal presence in Italy, the rules are more complex. If your company has incurred Italian VAT on legitimate business expenses, you can reclaim it. This might be attending a trade fair, importing goods temporarily, or purchasing services.

Whereas EU-based businesses file an electronic claim through their home country’s tax portal. Critically, non-EU businesses must appoint an Italian fiscal representative to handle the claim on their behalf.

This process involves meticulous record-keeping, submitting original invoices, and adhering to strict annual deadlines. You can expand to Italy by seeking our professional advice. You’ll have direct access to English speaking experts, and your team will be fully covered by Italian social security.

Summary: Getting VAT Right in Italy

Understanding VAT in Italy is essential for both individuals and businesses earning income locally. Whether you’re freelancing, consulting, or running a small business, VAT compliance is a non-negotiable part of operating legally in the country.

For non-residents and expats, working with an Employer of Record in Italy can make the entire process simpler and fully compliant—from VAT registration to tax filings and social security contributions.

If you’re working independently, you can also opt for our umbrella company model—a flexible solution that lets you contract legally in Italy without setting up your own Partita IVA.

Frequently asked questions

What is a VAT registration number in Italy?

It is your unique tax identifier for business activities, known as a Partita IVA. This number must be included on all your invoices and official documents. It allows the Italian tax authority to track all your VAT-related transactions and compliance.

How long does it take to get a Partita IVA (VAT number)?

With all the correct documents and assistance from a professional service, the process usually takes between two and four weeks. The timeframe can vary depending on the specific Italian province where you are submitting your application.

Are there any VAT simplifications for very small businesses?

Yes, the regime forfettario is a simplified scheme for businesses with turnover under €85,000. It replaces VAT with a substitute tax and greatly reduces administrative burdens. However, a key trade-off is that you lose the right to reclaim VAT on your business purchases.

I’m a freelancer with clients outside Italy. Do I need to charge Italian VAT?

The general rule for B2B services is that the place of taxation is your client’s location. You typically would not charge Italian VAT but must apply the ‘reverse charge’ mechanism, stating this clearly on your invoice. You are still required to report the transaction on your Italian VAT return.